Fokusgrupper og spørreundersøkelser for kunde- og markedsundersøkelser

Enten dere er ute etter konkurransedyktig innsikt eller har behov for å øke kundelojaliteten, er tilbakemeldinger fra kunder et av de mest verdifulle verktøyene man kan bruke.

Hvorfor? Tilbakemeldinger fra kunder gjør det lettere å forstå hva bedriften gjør riktig og hva den gjør feil, og de gir dere informasjonen dere trenger for å foreta forbedringer. Men det finnes ulike metoder for å innhente tilbakemeldinger fra kunder. Dere må velge mellom å bruke fokusgrupper og spørreundersøkelser.

Dette er en veiledning som kan gjøre det enklere å avgjøre hva man skal bruke, med fordeler og ulemper med fokusgrupper og spørreundersøkelser, og når man bør bruke det ene eller det andre for å få innsikt i hva kundene mener.

Hva er en fokusgruppe

Når markedsundersøkere gjennomfører en fokusgruppe, velger de nøye ut noen få personer som representerer ett bestemt målmarked eller brukerprofil. I en fokusgruppe stiller undersøkeren spørsmål og legger til rette for en diskusjon med gruppedeltakerne. Fokusgrupper er som regel interaktive, og de holdes på et nøytralt sted der folk føler seg komfortable med å fortelle hva de egentlig tenker.

Per definisjon er hensikten med en fokusgruppe å skaffe innledende kvalitativ innsikt i stedet for konkluderende kvantitative forskningsdata. Det er fordi man ikke analyserer et stort datasett. I stedet lytter man til meninger, perspektiver og personlige historier eller anekdoter. Dette kan gi et mer fullstendig bilde av kundeopplevelsen eller målgruppemarkedet, men det man hører vil ikke levere avgjørende bevis fra den større målgruppen man prøver å nå.

Når det er sagt, kan dataene man får fra en fokusgruppe gi verdifull innsikt om hva kundene tenker og hvorfor de tenker som de gjør. Med denne undersøkelsesmetoden kan man utvikle et produkt som er i tråd med markedet, lage engasjerende markedsføringskampanjer eller reagere på endringer i markedet.

Hva er en spørreundersøkelse

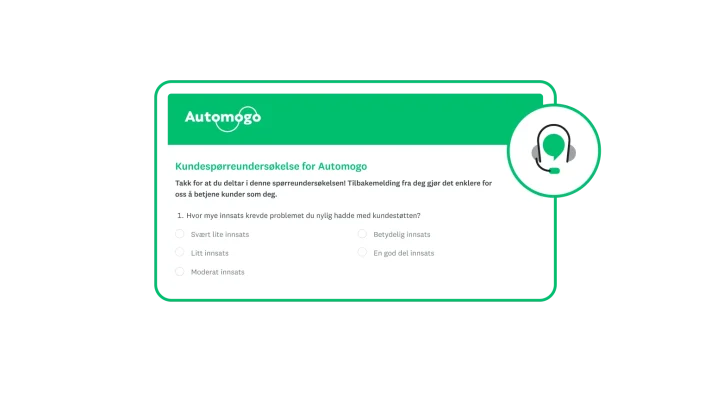

Spørreundersøkelser er en forskningsmetode som brukes til å innhente tilbakemeldinger fra et utvalg av personer. Spørreundersøkelser klassifiseres vanligvis som kvantitativ undersøkelse, og resultatene kan være konkluderende, i motsetning til resultatene fra en fokusgruppe.

Med spørreundersøkelser kan man stille spørsmål og måle nesten hva som helst. De kan være så korte som ett enkelt spørsmål eller ha flere hundre spørsmål. Svarformatene omfatter flervalg, vurderingsskalaer og åpne spørsmål.

Spørreundersøkelser gir stor fleksibilitet når det gjelder budsjett og tidspunkt. De kan imidlertid også oppfattes som lite fleksible, ettersom man ikke bør gjøre for mange endringer når man begynner å kjøre en undersøkelse. Spørsmålene må være konsekvente for å kunne samle inn nøyaktige data.

Fokusgrupper kontra spørreundersøkelser – hvilke bør brukes når

Før bedriften velger fokusgruppepanel eller undersøkelse, må dere skrive ned forskningsspørsmålene dere har. Deretter stiller dere flere spørsmål om disse spørsmålene. Med andre ord, tenk på hva slags informasjon dere trenger for å gjennomføre denne undersøkelsen.

- Kan dere få tilfredsstillende svar gjennom enveisspørsmål, eller ville det vært bedre å ha en samtale?

- Ønsker bedriften å teste et konsept eller en brukeropplevelse som kanskje krever mer forklaring?

- Ønsker dere å se deltakernes reaksjoner på egen hånd?

- Ville det vært greit å ta avgjørelser basert på noen få meninger?

- Trenger dere tilbakemeldinger fra et større utvalg for å få statistisk signifikante resultater?

Dere kan bruke en fokusgruppe for å komme nærmere kundene eller målgruppen. Lytt til hva som motiverer dem, gleder dem, eller problemene eller smertepunktene de har. Denne statistikken kan gi veiledning til et nytt produkt eller en ny tjeneste, gi konkurransedyktig innsikt eller styrke programmet for Kundens stemme.

Spørreundersøkelser er ofte knyttet til spesifikke hendelser, og dataene kan analyseres slik at dere kan gjøre målrettede, spesifikke forbedringer for organisasjonen. Dere kan for eksempel sende en spørreundersøkelse for tilbakemelding om kundeservice til en hvilken som helst kunde som har samhandlet med kundestøtte-teamet. Tilbakemeldingene dere får, kan hjelpe dere å spore viktige kundeservicedata og gjøre målrettede forbedringer.

Fordeler og ulemper med fokusgrupper og spørreundersøkelser

Er dere fortsatt ikke sikre på om dere bør bruke en fokusgruppe eller spørreundersøkelse? Dette er en nyttig liste for å hjelpe dere med å bestemme hva dere bør bruke til kunde- eller markedsundersøkelser.

Fokusgrupper

For

- Hør tilbakemeldinger fra kunder med kundenes egne ord.

- Oppdag ideer og smertepunkter som det interne teamet kanskje ikke har tatt hensyn til, men som er viktige for kunden.

- Fleksibilitet til å gå dypere inn i spørsmål under diskusjonen.

- Evne til å avklare tilbakemeldinger fra kunder ved å stille spesifikke oppfølgingsspørsmål.

Imot

- Utgiftene kan omfatte rekruttering av deltakere, lokale, leie, honorarer til moderatorer og/eller byråer, kompensasjon for deltakelse, reiser til flere lokaler for å se grupper og annet.

- Man kan få skjeve resultater på grunn av frittalende deltakere som dominerer gruppediskusjonene.

- Problemer med å rekruttere kvalifiserte deltakere på grunn av tiden deltakerne må bruke.

- Investering i form av en betydelig mengde tid og krefter på planlegging, organisering, rekruttering og (potensielt) reise.

Spørreundersøkelser

For

- Få tilbakemeldinger raskt. Avhengig av antall respondenter kan man motta resultater i løpet av 24–48 timer.

- Gjør det mulig å utforme undersøkelser én gang og deretter sende den samme undersøkelsen på nytt og på nytt over tid. (Dette gjør det dessuten enkelt å sammenligne og spore resultater.)

- Hvis undersøkelsen tillater anonyme svar, kan deltakerne være mer komfortable med å gi oppriktige tilbakemeldinger.

- Nå ut til mer enn én type kunder samtidig, og deretter dele opp dataene basert på en hvilken som helst variabel.

Imot

- For kunde- og markedsundersøkelser kan man få problemer med å rekruttere deltakere hvis man ikke har kundens kontaktinformasjon.

- Man kan ikke avklare tilbakemeldinger fra kunder ved å stille oppfølgingsspørsmål.

- Det er mulig deltakerne ikke har en måte å proaktivt gi tilbakemeldinger på problemer som ikke er med i undersøkelsen.

- Det er begrenset hva man kan spørre om fordi lengden på undersøkelsen har betydning. Det er mindre sannsynlig at respondenter gir gjennomtenkte, fullstendige svar på lange undersøkelser.

For begge typer undersøkelser må man gjøre lignende forberedelser.

Hvordan kjøre en fokusgruppe eller undersøkelse på en vellykket måte

1. Angi mål

Før dere skriver spørreundersøkelser eller gjennomfører fokusgruppen, må dere angi et mål for undersøkelsen. Dette målet er definert som det dere må gjøre for å komme dere videre eller ta en avgjørelse.

Ved å skrive opp målet eller målene (ikke for mange!) kan dere finjustere spørsmålene i spørreundersøkelsen eller fokusgruppene. I begge tilfeller vil respondentene og deltakerne i fokusgruppen være takknemlige.

Når dere definerer målene, kan dere i tillegg sørge for at undersøkelsene er i samsvar med bedriftens mål eller relevante resultatindikatorer. Det er også en god idé å samarbeide med viktige interne interessenter for å sikre at man stiller spørsmål som faktisk vil gi nyttig informasjon.

2. Rekruttere deltakere

Hvem vil dere skal ta undersøkelsen eller delta i fokusgruppen? Like viktig: hvem ønsker dere å ekskludere?

Deltakerne er viktige for at undersøkelsene skal lykkes. Så tenk på demografien til deltakerne, inkludert alder, kjønn, husholdningsinntekt, yrke og hvor de bor.

Har dere nødvendig kontaktinformasjon, eller trenger dere et undersøkelsespanel som kan hjelpe dere med å undersøke målgruppen? Ønsker dere at respondentene eller deltakerne skal være kjent med produktet eller produktkategorien dere tilbyr?

Hvis dere trenger hjelp til å finne de rette deltakerne for spørreundersøkelsen, kan SurveyMonkey Audience komme i kontakt med omtrent hvem som helst, basert på spesifikasjonene dere gir.

3. Utvikle en diskusjonsveiledning for fokusgrupper

Diskusjonsveiledningen ligner på et manus som ordstyrer kan bruke i fokusgrupper. Diskusjonsveiledningen strukturerer samtalen, styrer diskusjonen, tar opp det som er målet med fokusgruppen, og engasjerer alle deltakerne. Før dere lager en diskusjonsveiledning, må dere vurdere følgende:

- Hvilke spørsmål vil dere at moderatoren skal stille?

- Hva bør ordføreren vite om prosjektet for å svare på spørsmålene til deltakerne?

- Hvis dere tester et konsept eller en prototype, hvilke indikasjoner eller hint kan en moderator gi deltakerne?

- Hva bør moderatorene vite om forskningsmålene deres slik at de kan stille de riktige oppfølgingsspørsmålene?

Hvis dere bruker en markedsundersøker, kan dere begynne med målene for fokusgruppen, som bør samsvare med organisasjonens mål. Samarbeid med dem for å sørge for at dere stiller spørsmål på riktig måte og ikke overvelder gruppedeltakerne med for mange emner eller oppgaver.

4. Skrive gode undersøkelsesspørsmål

Hvis dere lager en undersøkelse, må dere følge disse beste fremgangsmåtene for å skrive gode undersøkelsesspørsmål og unngå vanlige spørreundersøkelsesfeil:

- Unngå ledende og belastede spørsmål

- Ikke still spørsmål med flere deler

- Vær forsiktig når dere stiller sensitive spørreundersøkelsesspørsmål

- Bruk et tydelig og greit språk

- Bruk riktig spørsmålstype

Husk å holde fokus. Målet dere har, avgjør spørsmålene dere stiller. Uansett om dere lager en transaksjonsbasert kontra relasjonell undersøkelse eller balanserer antallet lukkede vs. åpne spørsmål, må dere alltid ha målet i bakhodet.

Hvis dere fortsatt trenger hjelp til å lage pålitelige spørreundersøkelser og spørsmål, kan dere bruke de ekspertskrevne undersøkelsesmalene våre. Eller ta en titt på vår Lag med KI som kan ta spørsmålet ditt og skrive hele spørreundersøkelsen.

5. Vurdere forberedelse av fokusgruppedeltakere

For å få en fruktbar fokusgruppesamtale, bør man vurdere å forberede deltakerne. Forberedelser kan etablere forventninger slik at deltakerne er komfortable og trygge på å delta i en gruppesamtale.

Forberedelse av deltakerne kan se slik ut:

- Oppgi sted, tidspunkt og varighet for fokusgruppen

- Informer deltakerne om diskusjonstemaer

- Forklar eventuelle regler og retningslinjer, inkludert eventuelle taushetserklæringer

Må deltakerne gjøre noen aktiviteter eller forhåndsarbeid før undersøkelsen begynner? Vurder å planlegge en telefonsamtale eller sende en e-post for å informere deltakerne før fokusgruppen.

6. Sette av budsjett til belønning

Vurder fordeler og ulemper ved å gi belønning for kundemedvirkning. Hvor mye kan dere lønne deltakerne for tiden deres, om noe? For lengre undersøkelser eller fokusgrupper som tar én time eller mer, bør man vurdere å gi et gavekort.

Man må være forsiktig med hvor mye penger man tilbyr. Hvis man tilbyr for mye, kan noen ta undersøkelsen eller bli med i fokusgruppen bare for pengene, uansett om de faktisk er kvalifisert. Hvis man tilbyr for lite, motiverer det kanskje ikke potensielle deltakere til å gi gjennomtenkte svar.

Noen poeng til slutt om fokusgrupper kontra spørreundersøkelser

Som en hovedregel, hvis man ønsker en samtale med kundene som skal være veiledende, bruker man en fokusgruppe. Hvis man derimot har veldefinerte spørsmål og trenger å nå en stor gruppe eller flere kundegrupper, er en spørreundersøkelse det riktige valget.

Heldigvis trenger man ikke velge bare én metode for hvert prosjekt. Innsikten man får fra spørreundersøkelser og fokusgrupper kan utfylle hverandre. Spørreundersøkelser kan gi de kvantitative dataene og statistisk signifikante resultatene man trenger for å trekke konklusjoner. Men fokusgrupper kan gi en stemme til målmarkedet eller kundene, og uttrykke svaret på «hvorfor» som dataene ikke forteller.

Trygg undersøkelse av målmarkedet

Klar til å kjøre en fokusgruppe eller undersøkelse? SurveyMonkey kan være drivkraften i markedsundersøkelsene bedriften vil utføre. Test annonser og nye konsepter, overvåk merkevarens tilstand og få konkurransedyktig innsikt – dette er bare noe av det dere kan gjøre. Les mer om å nå målmarkedet.

Oppdag flere ressurser

Merkevaresjef

Merkevaresjefer kan bruke dette verktøyet til å forstå målgruppen, vokse merket og bevise ROI.

Statistikk for KI i markedsføring du må kjenne til i 2025

88 % av markedsførere bruker KI i jobben hver dag. Oppdag hvordan markedsførere kommer til å bruke KI i 2025, og hvordan dere kan ligge i forkant.

Se SurveyMonkey-løsninger for forbrukerprodukter og -tjenester

Bransjen for forbrukerprodukter og -tjenester, deriblant forbruksvarer, reiseliv, hotell og restaurant, benytter SurveyMonkey-innsikt for å forme fremtidige produkter.

Utforsk SurveyMonkeys løsninger for detaljhandel

Se hvordan SurveyMonkey hjelper detaljhandelen med å finne ut av nye markedstrender, utvikle produkter som begeistrer og bygge populære merkevarer.